Another foreign fund is investing in XTPL SA

The group of significant shareholders of XTPL SA now includes another investment fund from Germany; following XTPL’s first listing, the fund announced that it exceeded 5% of the total number of votes. Heidelberger Beteiligungsholding AG holds 102,000 shares of the Issuer.

Heidelberger Beteiligungsholding AG, belonging to the renowned German investment holding company, Deutsche Balaton AG, listed on the Frankfurt Stock Exchange, with the capitalization of EUR 192m, is a company investing in securities traded on the capital market, including mainly bonds and shares. Usually, the company chooses German assets, but it also takes attractive investment opportunities outside Germany, since its management board is not restricted in any manner with respect to regions, industries or the investment period. On 14 September, the fund announced that it exceeded 5% of the total number of votes in XTPL.

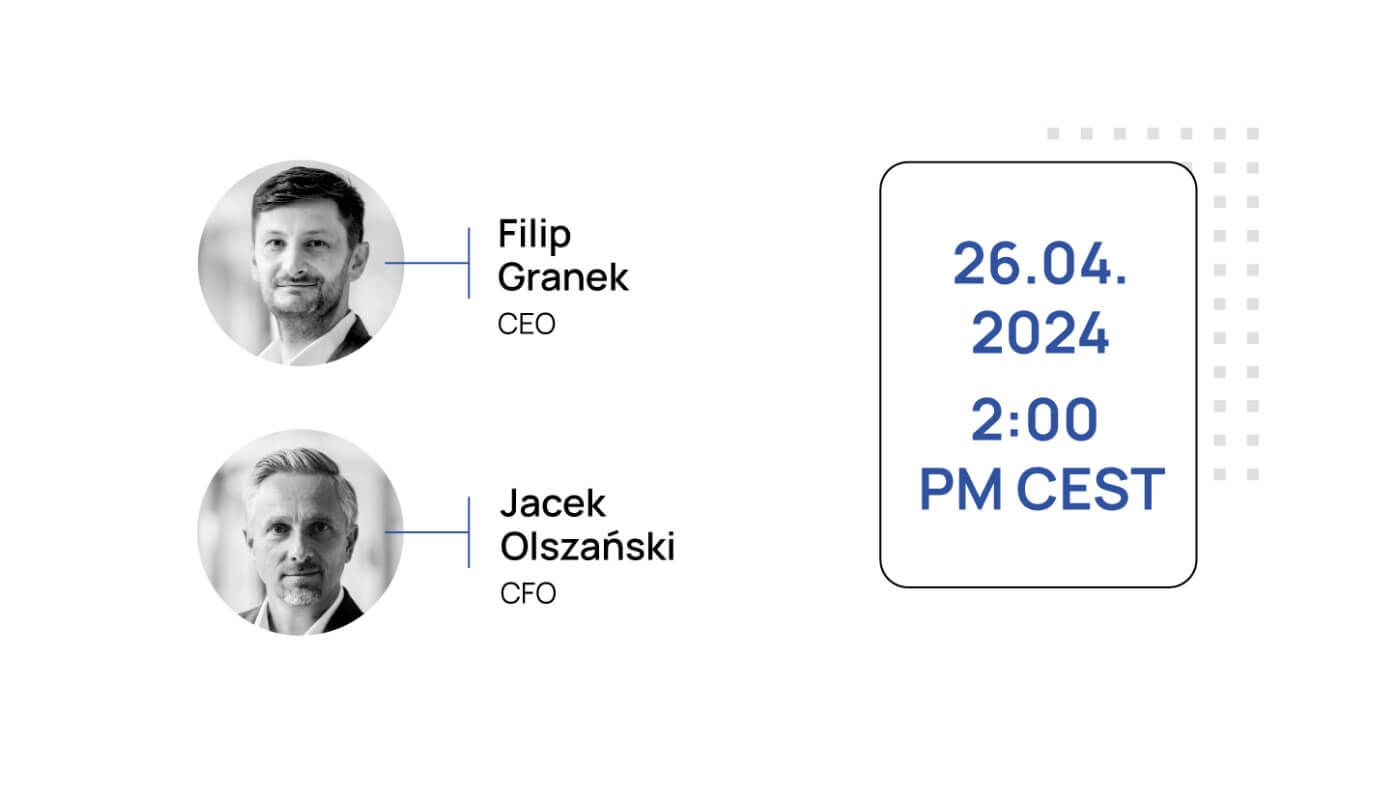

The interest shown by foreign investors confirms that our company is financially attractive and that the XTPL technology has a global-scale potential. One of the key points on our strategic agenda is to collaborate with international leaders in technology. Investors from outside Poland give us the opportunity to establish a close liaison with entities operating in foreign markets. The trust they have placed in our company adds more value and credibility to the XTPL technology, says Dr Filip Granek, CEO at XTPL SA.

Heidelberger Beteiligungsholding AG is the second foreign fund becoming a shareholder of XPTL. The first was ACATIS Investment GmbH which participated in the Issuer’s public offering and and took up over 5% of XTPL’s shares. ACATIS is one the best known investment funds in German-speaking countries and its assets amount to EUR 3bn.

Back to all articles

Back to all articles