XTPL reports another six months of strong revenue growth and secures financing for rapid scale-up

XTPL has published its set of results for the first half of 2023, boasting another period of robust increases in sales from the commercialization of all three business lines. In the first half of 2023, the Company generated over PLN 5.5 million in revenues from the sale of products and services, almost a double of the year-ago figure. Grants included, the total revenue for the first half of 2023 is PLN 6.9 million, up almost 50% year-on-year. In the second quarter alone, revenues from the sale of products and services were over PLN 2.5 million. Together with grants, they reached PLN 3.3 million. XTPL is making preparations for increased investment activities, a follow-up to the public offer completed in July this year that has brought the Company proceeds of more than PLN 36.5 million to accelerate growth and execute the investment plan for 2023–2026. The goal is to boost revenues from the sale of products and services 10 times to PLN 100 million by the end of 2026. XTPL expects that in the whole of 2023 it will fully use its production capacity for Delta Printing System (DPS) devices, with more than 10 units to be delivered and settled by the year-end. The Company delivered five DPSs during the first six months of the year alone.

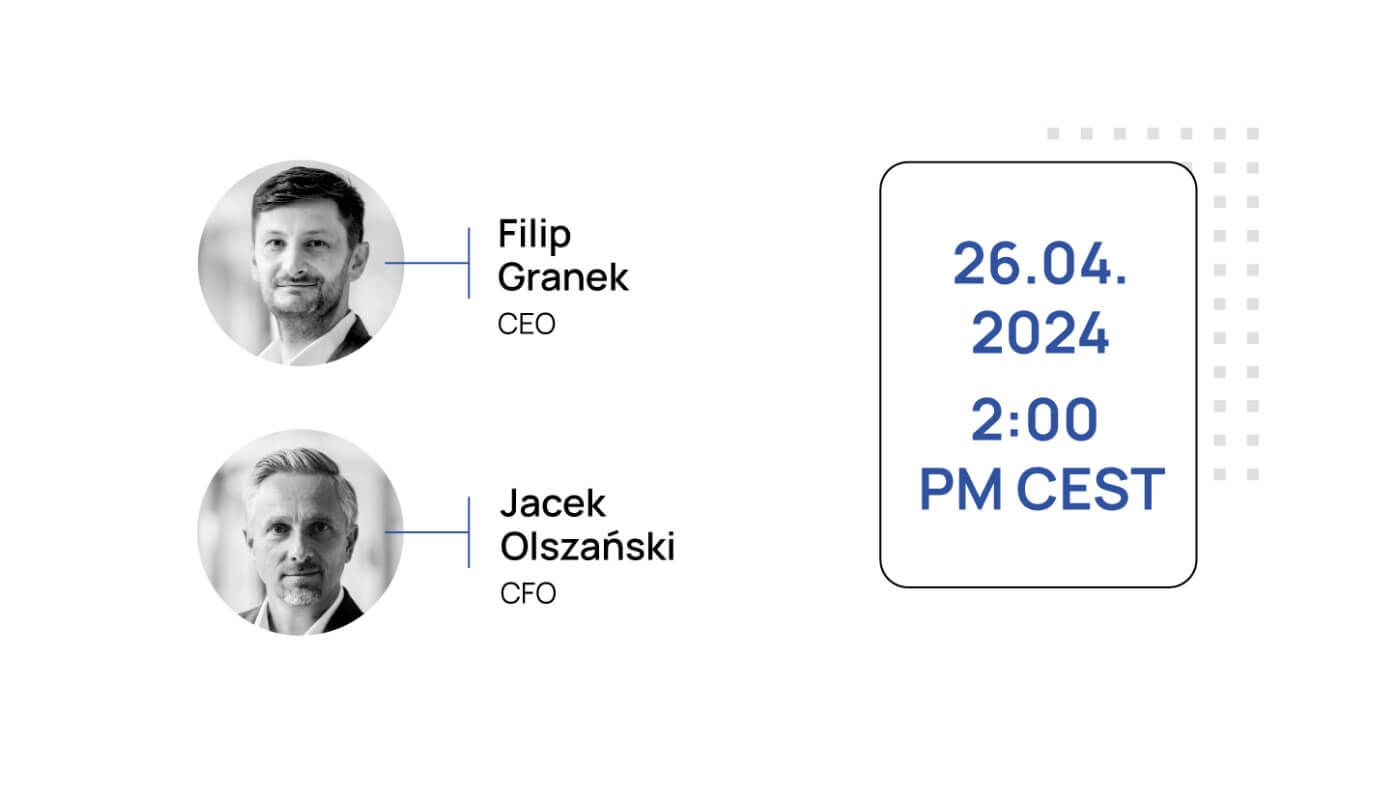

“I remember how thrilled we were when we received the first order for the Delta Printing System at the beginning of 2021. And today the number of orders has increased by another 20 in total. Five devices were delivered in the first half of 2023, with even more to be deployed for clients in the latter half of the year, which makes us optimistic about the revenue potential of the upcoming six months. What excites us now is the even greater acceleration of XTPL’s development and the scaling of our business to achieve the ambitious plan of a 10-fold increase in revenues from the sale of products and services to PLN 100 million by the end of 2026. To this end, in recent months we have carried out a successful issue of series V shares that has brought us proceeds of over PLN 36.5 million, with demand several times higher than the volume of the offer. On the one hand, this is testament to the efficacy of our business model and the validity of our growth prospect assumptions, and on the other hand, this secures a significant part of the financing needed for our 2023–2026 investment plan, which provides for the allocation of approx. PLN 60 million towards increasing our production capacity, supporting sales activities, or promoting R&D efforts” says Filip Granek, CEO of XTPL S.A.

In H1 2023, XTPL generated PLN 6.9 million in revenues, up almost 50% year-on-year, with revenues from the sale of products and services coming in at PLN 5.5 million, almost a double of the figure reported in H1 2022. In this period, EBITDA was PLN -0.8 million compared to PLN -2.2 million a year earlier. In H1 2023, the Company’s net loss was PLN -1.8 million, reduced from PLN -2.7 million in the same period last year. Cash flow for the first six months of the year was PLN -3.0 million, affected by the start of implementation of the Company’s investment plan. At end of June 2023, the cash position was PLN 3.0 million, and after the balance sheet date, in August, XTPL received proceeds from the series V share issue completed in July this year.

“We are focused on our goal to achieve PLN 100 million in revenues from the sale of products and services by the end of 2026. This means that our results in individual quarters might fluctuate in response to the delivery of our investments planned for 2023–2026. During the first half of the year, we consistently focused on commercializing our product portfolio. As a result, two more of our projects moved on to an advanced phase, i.e. the stage of building a prototype device containing our printing module for final tests on end clients’ production lines. One of those clients is a Nasdaq 100-listed leading manufacturer of industrial machinery, and the other client is one of the world’s largest manufacturers of Flat Panel Displays. This means that we already have four advanced industrial projects being developed in the areas we consider strategic, namely: semiconductors, displays and advanced PCBs. I’m emphasizing this business line not only because we expect to deliver printing modules in the second half of the year with a resulting positive contribution to results in that period, but primarily because in the long term this will be the key enabler of the XTPL business growth. The first full implementation of our technology on an industrial scale may significantly accelerate our other projects: nine in total, which are being developed simultaneously” says Jacek Olszański, CFO of XTPL.

In May this year, XTPL announced its plan to increase revenues 10 times to PLN 100 million by 2026. To achieve this ambition, XTPL intends to make investments of approx. PLN 60 million in 2023–2026 in three key areas: sales, production and R&D, designed to step up the Company’s development to respond to clients’ demand for the technology offered by XTPL. The investments planned are to be funded primarily from the share issue proceeds, while the remainder will come from equity (operating cash flows), grants and potentially, debt financing.

“We are pleased that the Company’s development is also recognized by the broad capital market, where – after the closing of the exchange session on September 15 – XTPL became member of the sWIG80 index. This will allow us to reach an even wider group of investors and, as we hope, will have a positive impact on the average trading volume in the long term. We’ve also earned an international recognition: for example, we were invited to participate in SEMICON Taiwan, the most globally significant event in the semiconductor industry. We are very pleased with the interest generated by our offering and with the number of business meetings we have. This makes us even more certain that the semiconductor industry is one of our key markets. On September 8 this year, we entered into an agreement on non-exclusive distribution of our solutions with Detekt Technology Inc., a company operating in Taiwan for 20 years, which will help us commercialize both DPS and industrial modules in that part of the world” Filip Granek adds.

XTPL’s business model is based on three complementary business lines. These are printing modules for industrial implementation on the production lines of global manufacturers of electronics, the Delta Printing System prototyping devices and conductive nanoinks. The Company has a total of nine projects aimed at industrial implementation of its technology, four of which are at an advanced stage of development. They cover all three areas the Company considers strategic: semiconductors, displays and advanced PCBs. The potential average annual revenues from all nine industrial projects being developed at present totals an estimated PLN 400 million. The Company’s end customers are global entities responsible for the production of next generation electronics, including a leading semiconductor manufacturer from Taiwan, one of the world’s largest producers of FPDs (Flat Panel Displays) from South Korea and a top manufacturer of industrial machines from the United States, listed on the Nasdaq 100 index.

Since its inception, XTPL has been operating a carefully developed industrial and intellectual property protection policy, having 8 patents granted and a total of 26 patent applications filed from September 2019 to September 2023.

Back to all articles

Back to all articles