XTPL to join the sWIG80 index as part of the September index review

XTPL, a global supplier of breakthrough nanoprinting solutions for the global market of modern electronics, it to be added to the sWIG80 index after the end of the trading session on September 15 this year. The inclusion of XTPL shares in the sWIG80 index comes as part of the quarterly review of the index composition. In 2023, the sWIG80 index noted the strongest performance in its nearly 30-year history, with a record-breaking closing price achieved at the trading session on July 18, 2023.

The quarterly index ranking was prepared after the trading session of August 18, 2023. The index structure takes into account the volume of share trading and the Monthly Turnover Ratio (MTR) for the last 12 months, counting back from the date of the ranking. The value of free float was calculated based on the closing price of August 16, 2023.

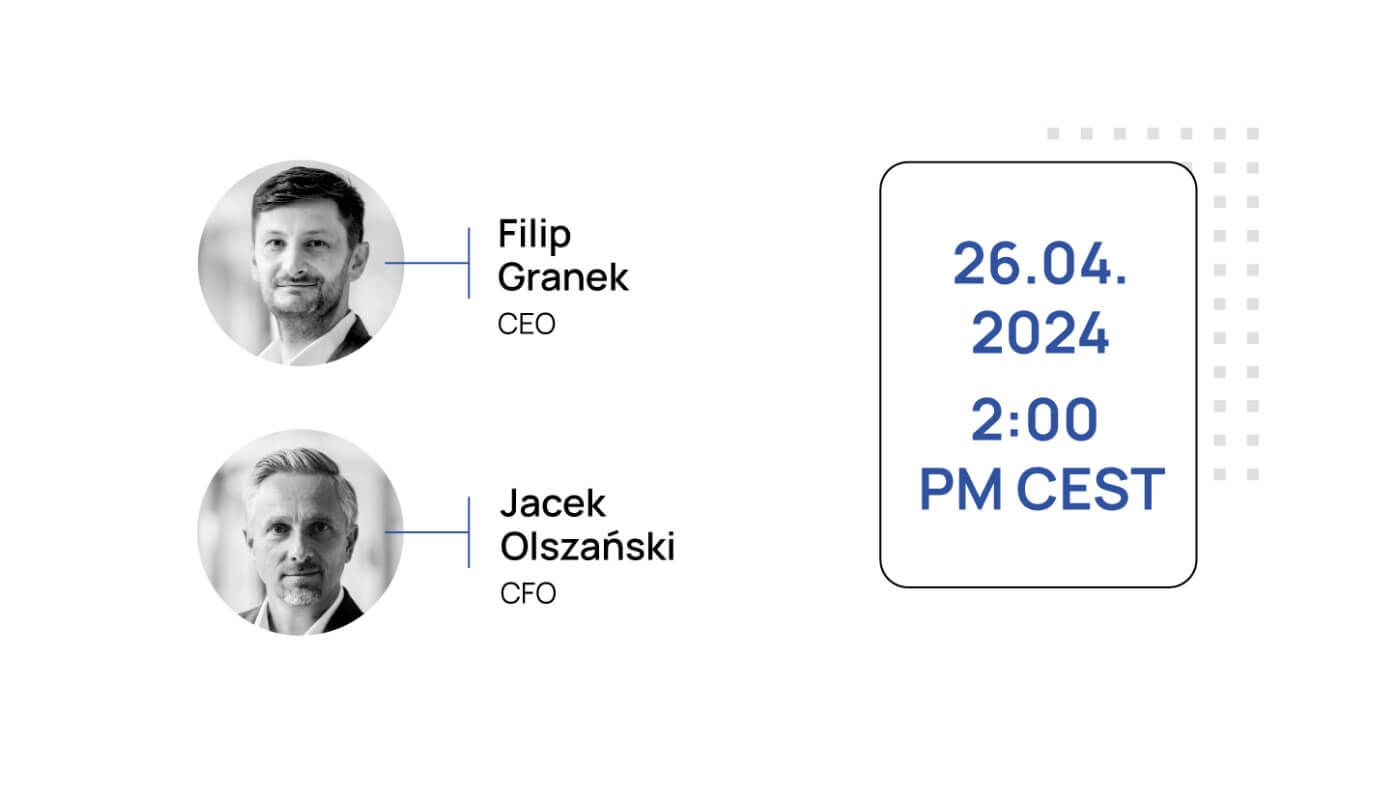

“Joining the group of members of the sWIG80 index is a great honor for XTPL, and gives us even more satisfaction with the work we have done to promote the company’s development. Despite its eight-year history, XTPL maintains a steep growth trajectory driven by our industrial projects designed to ensure that our technology can be widely used by global manufacturers of next-generation electronics around the world. We feel that we’ve done a decent job during the last eight years, especially taking into account Poland’s young deep tech market that is only gathering momentum and, I believe, is yet to see its best. The same applies to us: we are satisfied with our achievements, but we focus on what lies ahead, while pursuing ambitious and measurable goals. We intend to increase our revenues from the sale of products and services 10 times to PLN 100 million by 2026, with contribution from the development of all our three business lines. In particular, we are counting on our nine industrial projects, which are expected to bring average annual revenues estimated at even PLN 400 million, assuming their positive evaluation with our global partners. We have successfully completed a share issue, with proceeds of more than PLN 36.5 million obtained in July this year, aimed to accelerate our growth, and our business model has met with a positive response from both institutional and individual investors – Polish and foreign ones. The sWIG80 index is regularly followed by many investors, so we believe that this will be another positive factor to support strong development of our business. On the other hand, we hope that XTPL will make its contribution to the continued growth of the index and help it break new records moving forward” says Filip Granek, CEO of XTPL S.A.

The sWIG80 index includes 80 of the largest companies listed on the Warsaw Stock Exchange that are not members of the WIG20 and mWIG40 indices. Joining the main Polish indices, such as WIG20, mWIG40 and sWIG80, may result in a further increase in investor interest in the company and have a positive impact on the average daily trading volume and turnover.

XTPL was established on June 29, 2015, and debuted on the NewConnect market on September 14, 2017. After about 18 months spent on the alternative market, XTPL stock successfully moved to the Main Market of the Warsaw Stock Exchange on February 20, 2019. In addition, the Company started dual-listing on March 6, 2020 and is also listed on the Open Market in Frankfurt.

XTPL’s business model is based on three complementary business lines with a high potential to generate revenue streams, supported by R&D, and IP protection to maintain a long-term competitive edge. These are printing modules for industrial implementation on the production lines of global manufacturers of electronics, the Delta Printing System prototyping devices, and conductive nanoinks. The Company currently has 4 advanced projects geared towards industrial implementation of its technology. They cover all 3 sectors strategic for the Company: advanced PCBs, semiconductors and displays. The Company’s end customers are global entities responsible for the production of next generation electronics, including a leading semiconductor manufacturer from Taiwan, one of the world’s largest producers of FPDs (Flat Panel Displays) from South Korea and a top manufacturer of industrial machines from the United States, listed on the Nasdaq 100 index.

In May this year, XTPL announced its plan to increase revenues 10 times to PLN 100 million in 2026. The potential average annual revenues from all nine industrial projects being developed at present is estimated at approx. PLN 400 million. To achieve this ambition, XTPL intends to make investments of approx. PLN 60 million in 2023-2026 aimed at strengthening and accelerating the Company’s development to respond to customer demand, e.g. by increasing its production capacity, supporting sales activities and stepping up its R&D efforts. To fund the investments planned, XTPL intends to use the proceeds of PLN 36.6 million obtained from the issue of shares in July this year, with the remaining part of the financing to come mainly from equity generated in the course of operating activities, as well as from grants and debt financing.

In 2022, the value of the rapidly growing printed electronics market was USD 51 billion (+8% YoY), while in 2026 it is forecast to grow to USD 66 billion (source: IDTechEx). This means an increase in the market value at a CAGR of 7% in 2022–2026.

Back to all articles

Back to all articles