XTPL raises over PLN 36.5 million through the offer of series V shares aimed to accelerate growth and fund investments

XTPL, a global supplier of ground-breaking nanoprinting solutions for the next generation electronics market, has placed all 275,000 series V ordinary bearer shares covered by the offer. The issue price was set at PLN 133.00, which means that the offer totalled over PLN 36.5 million. Investors’ interest in acquiring the Company’s shares was very high, exceeding the size of the offer several times. The proceeds from the share issue will make it possible to fully utilize the commercialization potential of XTPL’s technology as part of the three business lines that the Company is developing. In 2023–2026, the Company intends to invest about PLN 60 million in key areas: sales, production and R&D. The business goal is to obtain PLN 100 million in revenues from the sale of products and services by 2026. During the process, the Company was supported by cc group – IR Advisor and Financial Advisor, while Trigon Dom Maklerski S.A. acted as the Investment Company and Book Manager.

XTPL’s offer covered 275,000 series V ordinary bearer shares issued by the Company in a private placement. Following the successful bookbuilding and subscription of shares by investors, the shares will represent 11.9% of the Company’s stock. The offer was addressed to investors selected by the Company’s Management Board.

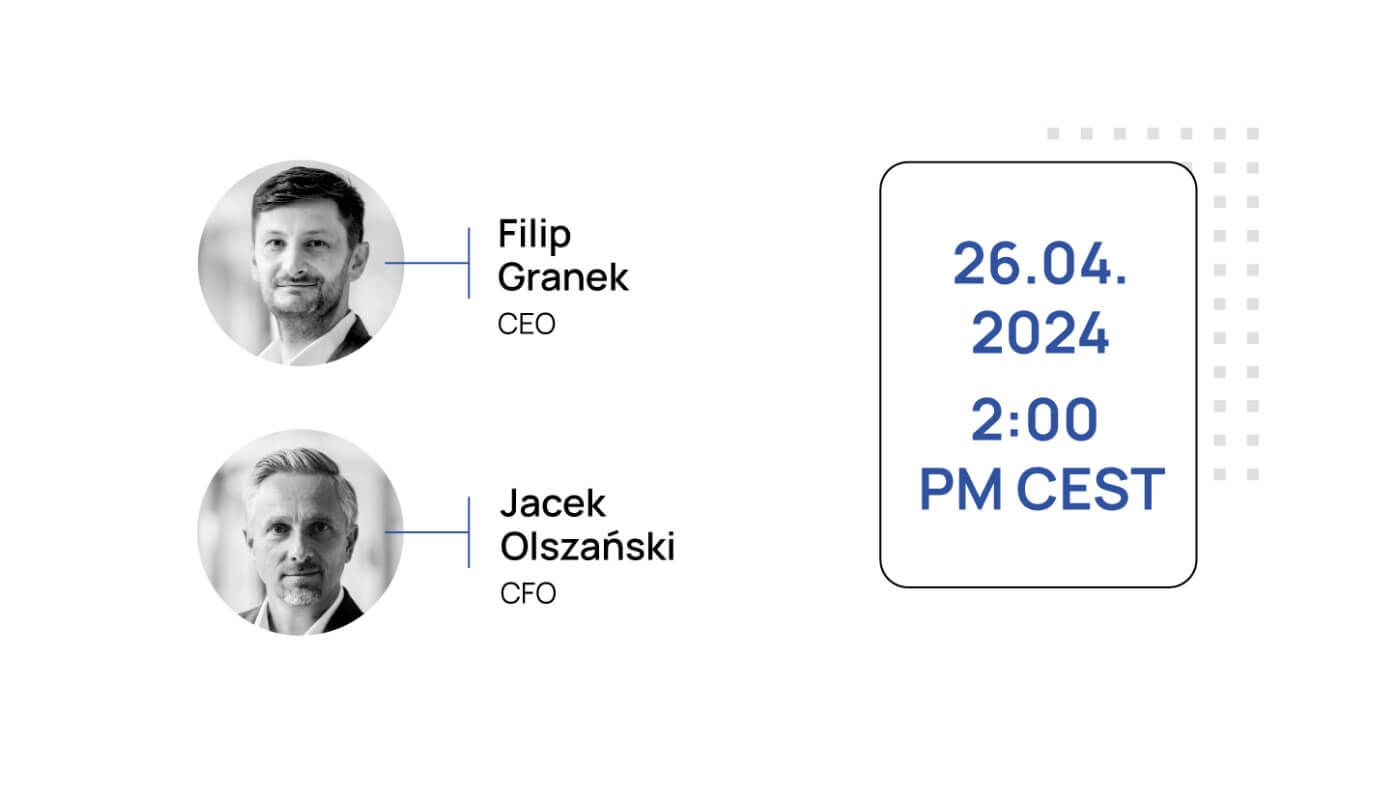

“We have successfully closed the offer of series V shares, which attracted a lot of interest from individual and institutional investors, as well as national and international entities, some of which were not previously present in our shareholding. I’m glad that we have passed the test of our development potential, and I’d like to thank all investors, Polish and foreign ones alike, for taking part in the offer and for putting their trust in us. We will make every effort to implement our approx. PLN 60 million worth of investment plan for the years 2023–2026, and exploit the strengths of our unique ultra-precise printing technology in a way that will allow us to implement it on the industrial lines of the largest next generation electronics manufacturers. Our firm business goal is to generate PLN 100 million in revenues from the sale of products and services by the end of 2026. This means a 10-fold increase compared to last year, and our ambition and long-term vision is to become one of the global standards for the production of advanced electronics, and join the huge value chain in this area, where the largest players can generate sales reaching tens of billions of dollars a year. We’re entering a very intensive period with ambitious goals that we have set for ourselves. And I believe we are well-prepared for the tasks that lie ahead,” says Filip Granek, CEO of XTPL.

In May this year, XTPL announced its plan to increase revenues 10 times to PLN 100 million in 2026. The potential average annual revenues from all nine industrial projects being developed at present is estimated at approx. PLN 400 million. To achieve this ambition, XTPL intends to make investments of approx. PLN 60 million in 2023-2026 aimed at strengthening and accelerating the Company’s development to respond to customer demand, e.g. by increasing its production capacity, supporting sales activities and stepping up its R&D efforts. To fund the investments planned, XTPL intends to use the proceeds from the issue of shares, and the remaining part of the financing is to come mainly from equity generated in the course of operating activities, from grants and debt financing.

“The proceeds from the share offer will represent a major part of the investments planned for 2023-2026, for which we intend to allocate about PLN 60 million. As we are gearing up for the implementation of our technology on an industrial scale, we primarily intend to increase production capacity in all three business lines we are developing, and to strengthen sales activities, including by opening international representative offices in our key markets: the United States, Taiwan and South Korea. We will also continue advanced R&D efforts to maintain our long-term competitive edge and implement next generations of our products, and – in the longer term – design new solutions. The business line of projects focused on industrial implementations is intended to be the key driver of the Company’s future growth. Assuming that we implement all the ongoing nine projects, the line’s estimated potential is around PLN 400 million in average annual revenues. At present, three of those projects are at the final stage of evaluating our technology, namely building a prototype device with our printing module for final tests on production lines of end customers – global manufacturers of next generation electronics,” adds Jacek Olszański, CFO of XTPL.

XTPL’s business model is based on three complementary business lines with a high potential to generate revenue streams, supported by R&D, and IP protection to maintain a long-term competitive edge. These are printing modules for industrial implementation on the production lines of global manufacturers of electronics, the Delta Printing System prototyping devices, and conductive nanoinks. The Company currently has 4 advanced projects geared towards industrial implementation of its technology. They cover all 3 sectors strategic for the Company: advanced PCBs, semiconductors and displays. The Company’s end customers are global entities responsible for the production of next generation electronics, including a leading semiconductor manufacturer from Taiwan, one of the world’s largest producers of FPDs (Flat Panel Displays) from South Korea and a top manufacturer of industrial machines from the United States, listed on the Nasdaq 100 index.

Since its inception, XTPL has been operating a carefully developed industrial and intellectual property protection policy, having 7 patents granted and a total of 26 patent applications filed from September 2019 to June 2023.

In 2022, the value of the rapidly growing printed electronics market was USD 51 billion (+8% YoY), while in 2026 it is forecast to grow to USD 66 billion (source: IDTechEx). This means an increase in the market value at a CAGR of 7% in 2022–2026.

Back to all articles

Back to all articles