XTPL plans to invest approx. PLN 60 m in its growth – the goal is to achieve a 10-fold increase in revenues to PLN 100 m by 2026

XTPL, a global supplier of breakthrough nanoprinting solutions for the next generation electronics market, has presented its business goal for 2026: to achieve PLN 100 million in revenues from the sale of products and services. The 10-fold increase compared to the revenues reported in 2022 is to be generated on the back of investments of approx. PLN 60 million in 2023–2026 in three key areas: sales, production and R&D. The record-breaking financial year 2022 closes the start-up stage of the Company’s life with a successful completion of the period of verifying the technology and its business potential and opens up a new chapter in the history of XTPL as a strongly growing company from the deep-tech sector focused on scaling its business. In order to finance the investments planned, XTPL intends to obtain approximately half of the required funds from a new share issue. It is the Company’s intention to give, if possible, the pre-emptive right to the existing shareholders holding more than 0.5% of Company’s share capital, with the remainder of the financing to be secured over the next 12 months in the form of debt capital, grants and equity.

The XTPL Management Board plans to call an Extraordinary General Meeting for the first half of June 2023

and issue up to 275,000 ordinary bearer shares addressed to investors who meet the requirements set out in the issue resolution.

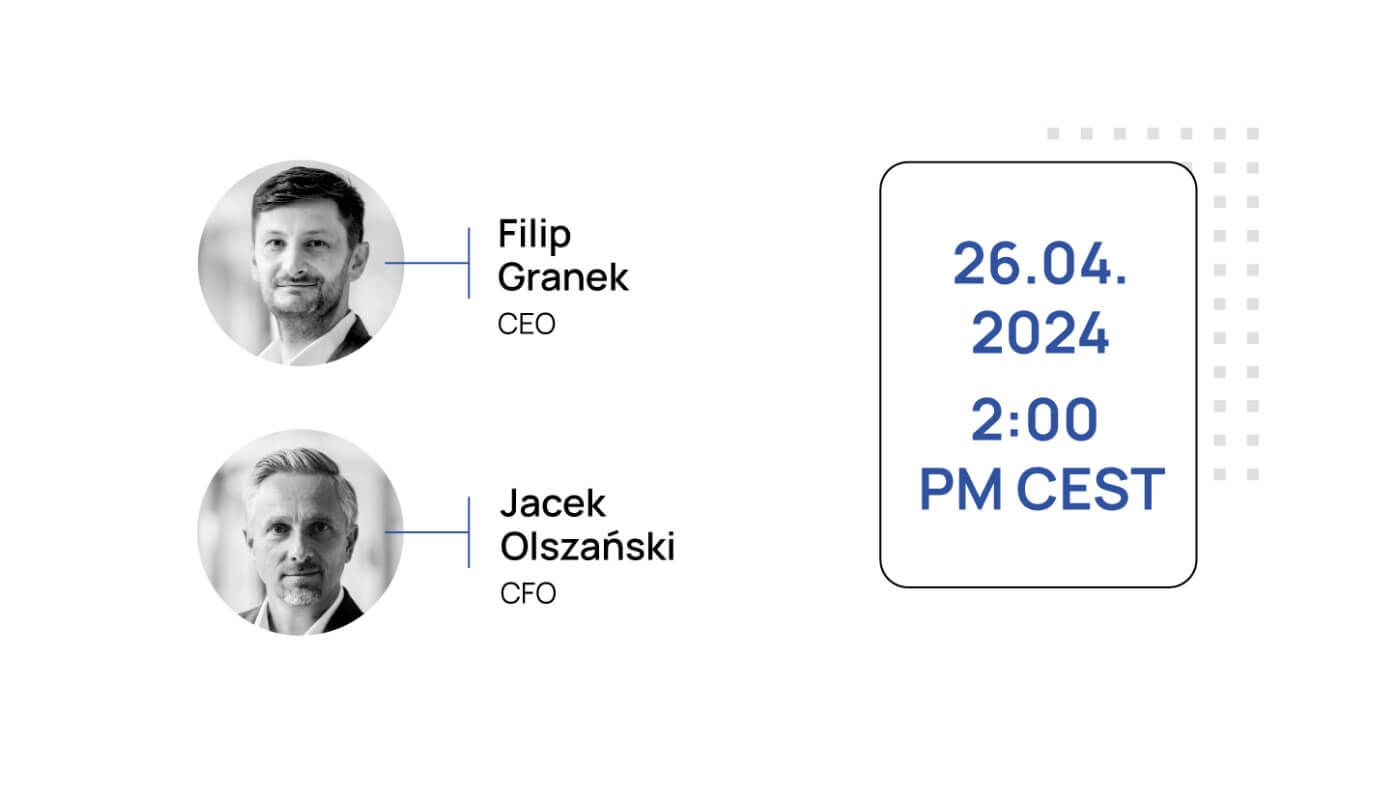

“Last year allowed us to successfully verify both our unique technology and the adopted business model, which is based on concurrent development of three complementary business lines with high potential to generate revenue streams. We achieved this amid the difficulties impacting markets and the economy in 2022, with prevailing high uncertainty and instability, soaring inflation and supply chain disruptions. This tremendous success for us has firmed up our conviction that the development course we set for ourselves is right and now we wish to speed up our growth, taking advantage of the improving economic environment and the pronounced increase in interest in our product offering and technology by global players, with whom we are able to achieve implementation on an industrial scale and in this way completely redefine our position on the international stage” says Filip Granek, CEO of XTPL.

“As of the fourth quarter of 2022, we have already confirmed 9 new orders for our Delta Printing System prototyping devices, which is over 50% of the total orders we have generated since 2020 (17 orders in total) and we see space to maintain strong momentum for this line of business. The investments planned will allow us to triple the production capacity of the Delta Printing System devices, so we can comfortably handle several tens of orders per year. The investments will also include expansion into foreign markets and the opening of new sales centers. However, above all we intend to increase the production capacity for our printing heads for industrial implementation, going from a small number of units per year to about 100 annually. As we increase production capacity, we wish to strengthen our R&D area, which will enable us to expand the scope and number of our industrial projects and add new products from the conductive inks line to our offer. That said, we are investing in all three key areas: sales, production and R&D, and we are increasing employment by hiring experts with world-class expertise and skills. The purpose of these efforts is to achieve sales of PLN 100 million in 2026, which is what I and the whole XTPL team are focusing on. As one of the main shareholders of the Company, I will take part in the new issue of shares” Filip Granek adds.

In 2022, XTPL achieved revenues of PLN 12.8 million, nearly three times more year on year, with revenues from the sale of products and services surging to more than PLN 10.0 million from PLN 2.1 million achieved in 2021, which is a nearly fivefold growth. This means an almost 80% share in the total commercial sales revenues, with the rest being represented by grants. In the whole of 2022, EBITDA, adjusted for the cost of the incentive scheme, was positive at PLN 0.4 million, growing by PLN 4.9 million year on year. With those results, net loss for 2022 was reduced significantly by nearly PLN 4.5 million to PLN -2.1 million compared to PLN -5.7 million in 2021. Net cash flows were positive at PLN 1.5 million, up PLN 7.3 million YoY. Operating cash flows were PLN 4.7 million, up PLN 8.5 million YoY. The Company’s cash position as at December 12, 2022 increased to PLN 6.0 million.

“The decision on the investments planned for 2023–2026 opens up a new chapter in the development history of XTPL, where we will focus on the medium-term goal: to achieve PLN 100 million in revenues from the sale of products and services in 2026. The strengthening of the Company’s growth aimed at the 10-fold increase in sales within 4 years is a priority for us and in the short term might dent our financial results and net profit margin. We have estimated the planned investments, which are designed to maximize our sales potential by 2026, at approximately PLN 60 million. The scale of transformation that XTPL has seen over the recent years allows us to raise financing not only in the form of a new share issue, but also using debt capital. We expect to obtain about half of the required funds from the issue of shares, with the remainder to be obtained through a combination of debt financing, grants and equity. Let me emphasize that we’re seeking to become a major player in the market of global suppliers of nanoprinting solutions for the next generation electronics sector and in the current phase of the Company’s development our key priorities are rapid business scaling and sales growth, which I trust will be visible in our 2023–2026 annual results, says Jacek Olszański, CFO of XTPL.

XTPL’s business model is based on three complementary business lines with high potential to generate revenue streams. These are printing modules for industrial implementation on the production lines of global manufacturers of electronics, the Delta Printing System prototyping devices, and conductive nanoinks. XTPL is currently doing nine projects geared towards industrial implementation of its technology. Three of those are at an advanced stage, covering all three sectors strategic for the Company: advanced PCBs, semiconductors and displays. The Company’s end customers are leading and global entities responsible for the production of next generation electronics, including one of the world’s largest producers of FPDs (Flat Panel Displays).

Since its inception, XTPL has been operating a carefully developed industrial and intellectual property protection policy, having 7 patents granted and a total of 26 patent applications filed from September 2019 to May 2023.

In 2021, the value of the rapidly growing printed electronics market was USD 47.1 billion (+14.5% YoY), while in 2025 it is forecast to grow to USD 63.3 billion (source: IDTechEx). This means an increase in the market value at a CAGR of 9.0% in 2020–2025. According to market analyzes, the market of electronic prototyping devices (the category that includes the Company’s DPS prototyping devices) is to see a CAGR of 31% in the years 2021–2031 (source: Transparency Market Research). Global annual sales of systems for R&D, rapid prototyping and small-lot production in the area of printed electronics sector amount to approx. 250–500 devices per annum, at a price of approx. EUR 50–500 thousand per device.

Back to all articles

Back to all articles