XTPL reports a surge in revenues from the sale of products and services

Nearly PLN 3 million posted in H1 2022, and a 21-fold increase year-on-year. XTPL S.A., a global supplier of ground-breaking nanoprinting solutions for the world’s modern electronics market, has presented its official set of results for the first half of 2022. The consistently pursued growth strategy helped achieve total revenues of PLN 4.8 million: PLN 3.0 million from the sale of products and services and PLN 1.8 million from grants. In terms of commercial revenues, in Q2 alone, XTPL generated PLN 2.0 million, up 119% quarter-on-quarter, as much as 98% of the sales achieved in the whole of 2021. In H1 2022, EBITDA was PLN -2.2 million, representing an improvement year-on-year, especially on the back of the net profit of PLN 0.2 million posted in Q2. The Company started to generate positive cash flows from operating activities: PLN 0.1 million in H1 2022 and PLN 0.3 million in Q2 2022. The cash position of PLN 3.5 million at the end of June 2022, coupled with the upward trend in earnings and the effective use of grant projects allow the Company to continue its rapid growth and finance its operations from equity.

XTPL’s results in the first half of 2022 were significantly helped by the payment tranche received in respect of the completed stage of work under the cooperation (started in January) with the US NASDAQ-listed Israeli company Nano Dimension. Implementation of projects with industrial partners is XTPL’s key business line. Currently eight more projects carried out with global entities are at the stage of evaluation of the innovative technologies developed by the Company.

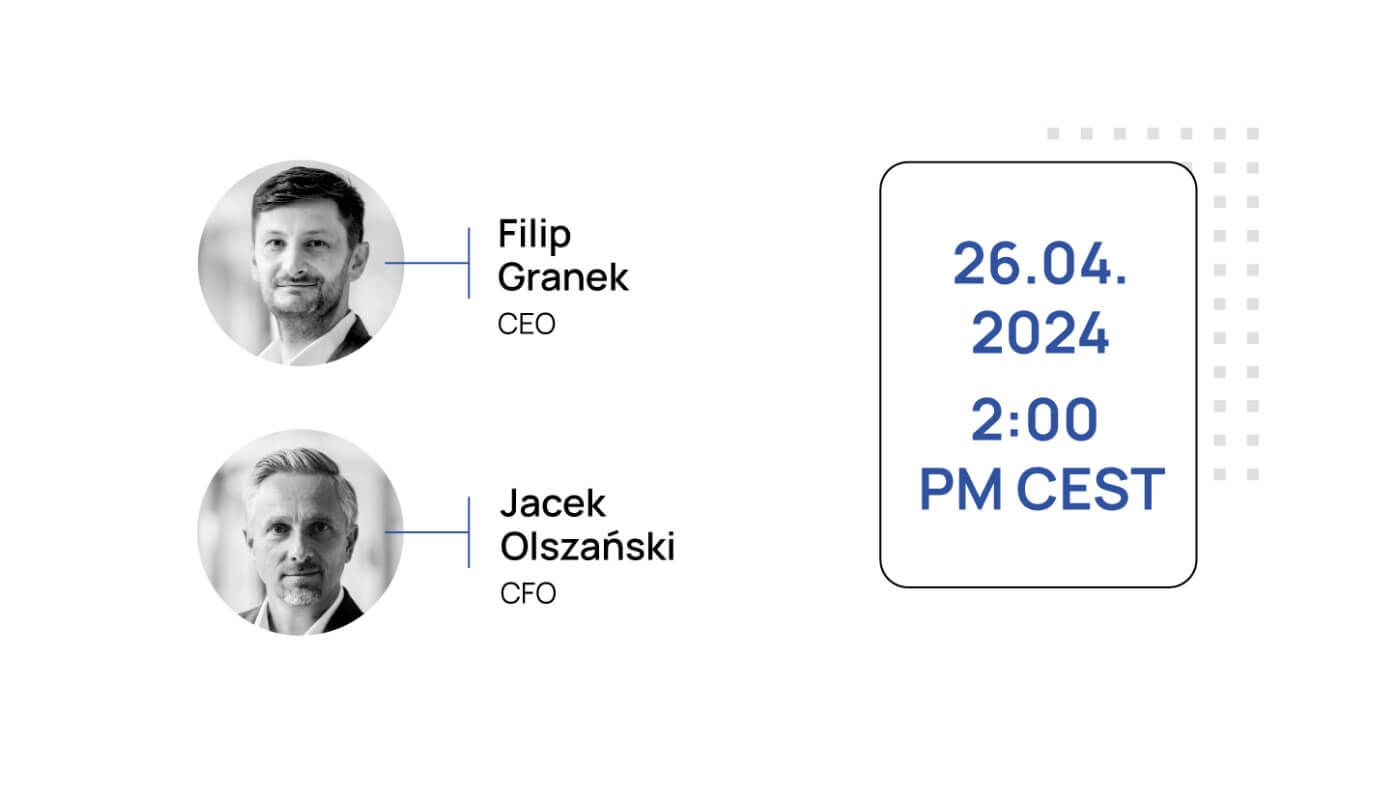

“This year, XTPL has made significant progress in terms of technology commercialization and development of all its three business lines, which is directly reflected in its financial performance. We have fully completed the process of transformation from a research and development entity into a company that is already successfully commercializing its solutions. Of note is our first relationship with an industrial partner, started in January this year, where after a period of approximately 18 months of detailed validation and negotiations, we signed an agreement with the Israeli company Nano Dimension. Over the recent months, we also started execution of an order for delivery of a printing module for industrial integration for a partner from Taiwan, following an evaluation process. The global nature of our business and the versatile technology of Ultra-Precise Deposition (UPD) of conductive structures constitute a competitive advantage on a global scale and allow us to look ahead with optimism at our current and future world-wide partnerships that are bound to benefit XTPL,” says Filip Granek, CEO of XTPL.

Financial perspective

The Company’s business model is based on three complementary business lines with high potential to generate revenue streams. These are printing modules intended for industrial implementation on the production lines of global manufacturers of electronics, the Delta Printing System prototyping devices, and conductive nanoinks. The partnerships involving industrial implementations have the greatest positive impact on the Company’s financial results, while the regular sales of DPS systems and nanoinks have a stabilizing effect on the revenues.

In the first half of 2022, XTPL generated consolidated revenues of PLN 4,786 thousand, including PLN 2,970 thousand from the sale of products and services, a 21-fold increase year-on-year. In Q2 2022 alone, these figures were PLN 3,167 thousand and PLN 2,040 thousand, respectively, representing a significant improvement quarter-on-quarter, growing by 96% and 119%. In H1 2022, EBITDA was PLN -2,244 thousand, driven by the positive figure of PLN 152 thousand generated in Q2 alone, which shows that the Company, thanks to the increases in its core business, is starting to generate positive EBITDA levels. In consequence, for the first time in its history, the Company achieved a positive change in cash flows from operating activities: PLN 117 thousand on a six-month basis. The upward trend in results, cost discipline and safe cash position at the end of June 2022 (PLN 3,465 thousand vs PLN 3,705 thousand as at 31 March 2022) facilitate further strong growth of the Company and a gradual decrease in the share of grants in total revenues. In the reporting period, grant revenue was PLN 1,816 thousand, including PLN 1,127 thousand achieved in Q2 2022. These funds are used in research projects that are key to the Company’s ability to retain its competitive and innovative edge. The total value of grants obtained in the first half of 2022 was PLN 2,377 thousand, including PLN 561 thousand recognized in the Company’s balance sheet as advances and grants to assets.

“Growing revenues across the Company’s business lines confirm the effectiveness of XTPL’s consistently pursued development strategy. The size of our business is starting to drive major revenue increases, and given the fact that historically we tended to present stronger results in the second half of the year – with revenues from the completion of the second stage of the technological phase under the agreement with Nano Dimension to be also taken to that period – we are optimistic about the upcoming months. In addition, the grants from NCBiR, the National Centre for Research and Development, or the grant under the European Commission’s Horizon Europe Framework Programme awarded to all members of the consortium to which XTPL belongs remain an important part of our business, but mainly as enablers of innovative technological solutions, as we are already starting to finance our operations from our own, growing sources of income,” says Jacek Olszański, CFO of XTPL.

In July, the Company agreed with investors holding bonds with a total nominal value of PLN 3,378 thousand to change the bond redemption date from 30 July 2022 to 30 January 2024.

Business perspective

In the first half of 2022, XTPL continued the development and sale of its DPS (Delta Printing System) prototyping devices. In addition to having a positive impact on financial performance, this also resulted in establishing strategic cooperation with the University of Brescia in Italy. Originally, the university acquired the DPS in December 2021, and after testing the device’s capabilities, decided to strengthen its cooperation with XTPL. The Company, together with scientists from Brescia, will work on the application of XTPL technological solutions in the biosensor sector. Another development demonstrating the high utility of the DPS in the field of printed electronics R&D was the recent use of the DPS purchase option by the University of Stuttgart, which previously employed the device under a lease agreement.

Stable sales of DPS prototyping devices are also confirmed by recent transactions. On 1 August 2022, the device was purchased by IRIS Adlershof Institute from the prestigious Humboldt University in Berlin, which will use the technology of ultra-precise deposition of nanomaterials for the electronics industry in work on new sensor, photovoltaics and optoelectronics solutions. In turn, 3 August 2022 saw execution of an order for the delivery of a DPS device whose final buyer will be a leading Chinese research and development center from Beijing, which will use the XTPL technology in work on advanced integration of semiconductor elements in a new class of devices. The sale was made possible thanks to the order placed by Yi Xin (HK) Technology Co. Ltd, based in China, the distributor of XTPL technological solutions. In addition, on 31 August this year, the IGM Institute (Institut für Großflächige Mikroelektronik) of the University of Stuttgart decided to use the option to buy the Delta Printing System that it had so far employed used a lease agreement. IGM is historically the first external user of DPS, and its decision to buy the device before the end of the lease confirms its high usefulness in the area of printed electronics R&D.

As part of the nanoink business line, in the first half of 2022, XTPL completed 11 independent orders from the EMEA region and America, which is a double growth year-on-year. In terms of the structure of buyers, nearly half of sales are generated with the industrial sector. Furthermore, in Q2 an agreement was signed with the US company nScrypt based in Orlando, Florida, providing for the sale of conductive Ag CL85 nanopaste developed and produced by XTPL. This is the first private label agreement where the Company’s product will be offered on the foreign market under the nScrypt brand. The US partner’s customers include military, academic and research institutes, government agencies and national labs, as well as privately-owned technology corporations.

“Markets such as the United States, China and large centers located in Europe are crucial for the development of the printed electronics industry, and the cooperation we established in 2022 alone in these geographical areas cause the XTPL technology and our innovative solutions to gain more and more recognition and attract the interest of other potential clients. Our strong presence in the scientific community on the back of our strategic cooperation with the University of Brescia in Italy concerning the use of our technological solutions in the field of biosensors, or our participation in many industry events where we present XTPL solutions on the international arena, pave the way to further talks with potential partners for industrial implementations, which constitute a strategic area with the highest potential for the Company. The industrial project contracts signed with Nano Dimension and our partner from Taiwan, which were preceded by many months of evaluation of our technology, are a great success and testament to the attractiveness of our solutions, which brings us closer to the realization of our vision, namely the use of XTPL technological solutions in the mass production of next generation electronics,” Filip Granek adds.

In the process of commercialization and reaching out to potential clients, the Company is supported by an international network of distributors, which in H1 2022 was expanded to include two new partners. In the Western European market, XTPL is represented by merconics from Germany, and by Vertex Global Solutions in the promising Indian market. Currently, the Company has a total of five distributors. In addition to the above names, these are: Bandi Consortia in South Korea, Yi Xin (HK) Technology Co. Ltd in China and Semitronics Ltd. in the British Isles. The experience, knowledge and business relations of the network of distributors that XTPL cooperates with help the Company actively expand the scope of the potential application its technology and products in the most promising markets.

Building the Company’s value and technological solutions is also supported by properly developed and implemented policy of industrial and intellectual property protection. Ever since its establishment, XTPL has been consciously creating its patent cloud. In January, the Japanese Patent Office granted the Company patent protection for the method of forming lines less than 1 micrometer wide (1 micrometer is one millionth of a meter) using the XTPL proprietary ink with silver nanoparticles. Previously, that patent application was granted protection in the United States, China and Germany. In turn, in May 2022 and September 2022, the United States Patent and Trademark Office granted patents to the Company for its method of forming lines of several hundred nanometers wide using the XTPL-developed silver nanoink. Currently, the Company has 3 patents and 25 active applications in total.

In 2020, the value of the rapidly growing printed electronics market was USD 41.2 billion (+11.0% YoY), while in 2025 it is forecast to grow to USD 63.3 billion (source: IDTechEx). This means an increase in the market value at a CAGR of 9.0% in 2020–2025. According to market analyzes, the market of electronic prototyping devices (the category that includes the Company’s DPS prototyping devices) is to see CAGR of 31% in the years 2021–2031 (source: Transparency Market Research). Global annual sales of systems for R&D, rapid prototyping and small-lot production in the area of the broadly understood printed electronics sector amount to approx. 250–500 devices per annum, at a price of approx. EUR 50–500 thousand per device.

Back to all articles

Back to all articles