Successful Issue of XTPL Shares

More than PLN 10 million was credited to the XTPL’s account as a result of the recent issue of shares. In the capital increase carried out in the private subscription mode both Polish individual investors and Western institutional investors took part. The latter acquired nearly a half of the new securities. The company intends to allocate the funds especially for the strategic strengthening of commercialization in the area of open defect repair and for further development of its patent cloud.

The completed issue of series S shares was range-based and took the form of a private placement. The investors took up 78,000 new shares, the maximum pool from the range of 68–78 thousand shares planned in this share capital increase within the authorized capital. The final range of shares issued was wider than the company originally expected. This is the effect of receiving by XTPL a declaration of interest from investors on a larger number of shares than previously estimated – the management board’s initial proposal was to increase the share capital by 55–65 thousand shares. The newly issued shares constitute less than 5% of the increased share capital of the company.

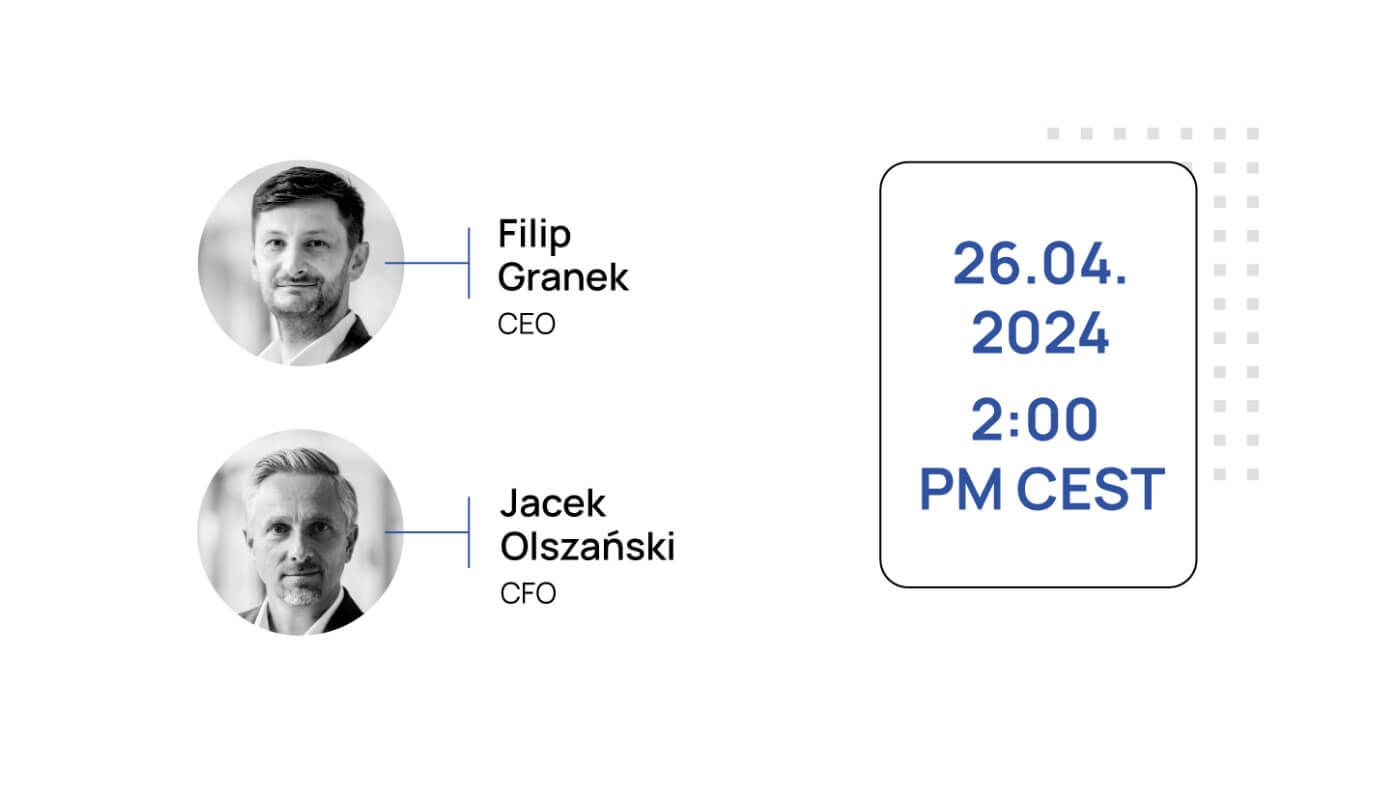

– Development of a breakthrough technology for the electronics market is a capital-intensive and time-consuming process. For this reason, at the current stage of development, we primarily rely on support from long-term investors, experienced in the analysis and evaluation of companies such as XTPL. The recently completed share issue was a full success. In addition to the German investors who decided to invest again, new Western investors joined the group of our shareholders. In total, foreign entities took up almost half of the shares offered. As a result, XTPL not only gained funds to strengthen its business development activity, but also made another step towards making its shareholding structure more international. This is desirable for a company developing its technology on a global scale. It is worth noting that investors from Poland also took up a significant part of the increased share capital. We are happy to attract interest from investors who are patient and ready to offer long-term support for XTPL – emphasizes Filip Granek, CEO and co-founder of XTPL.

More than PLN 10 million obtained from the sale of XTPL shares will strengthen the company’s capital position. Equally important as technology development is the protection of intellectual property, which shows the considerable value of XTPL.

The acquired funds will also be allocated to this purpose. This is particularly important as the XTPL solution arouses more and more interest, especially in the display industry, and this means that appropriate protection of intellectual property gains in importance.

– At present, we see significant development potential in implementing on the market our solution for repairing open defects of conductive paths occurring at the production stage in high-resolution displays. To intensify our activity in this area and to continue efforts to protect XTPL’s intellectual property requires us to increase our expenditure right now. The outcome of the completed issue of shares gives us a clear signal that there are more and more investors wanting to support our company in the long-term building of its value – Filip Granek adds.

Developing and preparing for the industrialization of XTPL solutions is a complicated and multi-stage process. Its delivery, completed with implementation of the technology on the production lines of leaders of specific industries, will give the company an advantage in the form of high entry barriers for potential competitors. The very same process also creates high barriers to exit the business relationship for XTPL partners. Incorporation of the new technology into the client’s production line significantly increases the probability of long-term cooperation and repeatability of repeatable revenues.

Back to all articles

Back to all articles