XTPL – German MainFirst Bank AG recommends “BUY”

- German MainFirst Bank AG from the Stifel Group recommends “BUY” with regards to XTPL and valued the company share at a PLN 210 price target.

- XTPL is the first Polish company covered by MainFirst

- MainFirst recognizes that the first tangible results in the commercialization process of XTPL are visible.

After meeting with the representatives of MainFirst Bank AG during the Virtual Equity Forum Conference, XTPL received an analytical report. According to the German analysts, the valuation of the XTPL results in a PLN 210 price target. The valuation confirms the potential for commercialization of XTPL technology.

During the meeting Management Board of XTPL clearly outlined what differentiates XTPL from the competition and alternative or classic printing methods, i.e. a combination of high-viscosity printing inks, very small feature size, and a combination of both without clogging the printing-nozzle. Moreover further moves into even higher viscosity scales and lower feature sizes should help protect XTPL’s unique market positioning. According to the MainFirst, looking for the different sales channels by XTPL for its products can contribute to a sustainable recurring revenue stream in the medium term.

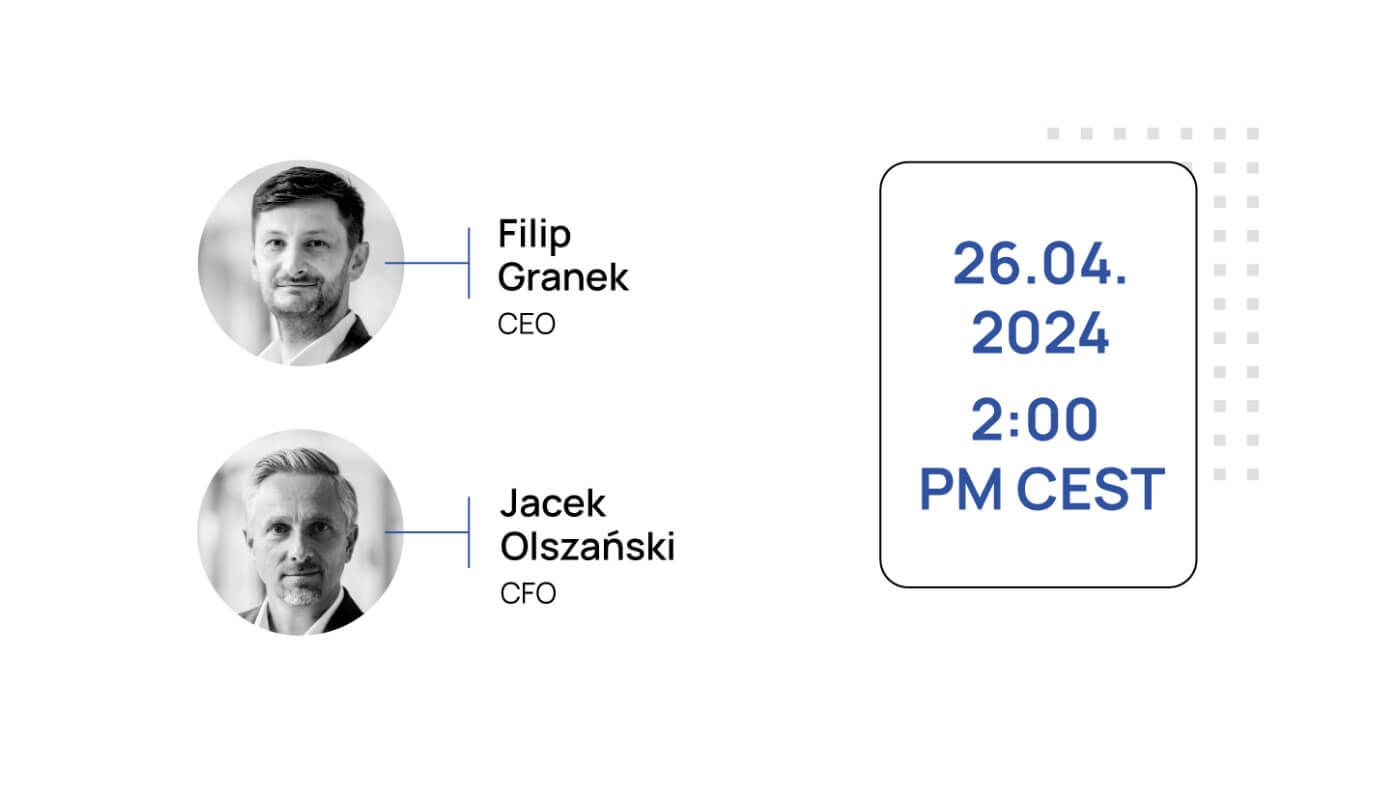

“The assessment by MainFirst Bank AG is confirmation of the XTPL potential and our continued progress in the commercialization of our technological solutions. Earlier this year we completed our first sales transactions – and it’s just the beginning” – says Filip Granek, CEO of XTPL.

MainFirst is a European financial services firm, specializing in Equity Brokerage, Investment Banking and Fixed Income which is following about 400 predominantly European stocks.

The report was commissioned and paid by XTPL.

Back to all articles

Back to all articles